3 min bacaan

If you are someone who eager to invest and make a quick buck, you will have a moment where you feel confident to buy a company that a publicly listed in Bursa Malaysia. However, fear not, you actually don’t have to buy those shares.

Instead, what you should do?

1. Look at who own the company

Since you are someone who eager to invest and make a quick buck, this presume that you are actually have a very low risk appetite since investing in equities is risky for a “quick buck”.

Also, making quick buck means, you are neither actually interested in controlling the company business direction nor capable of doing it (by having majority-say in the company).

Having low risk appetite means, you are unable to tolerate a loss of capital.

No citation. I made up my mind.

So, you should look at who own the Ticker symbol. So, in this example, let’s take VELESTO as an example.

2. Where to look at who own the company?

Open your KLSE Screener application on your phone and then click on Search button, input your ticker symbol (in this case VELESTO) and click SEARCH FOR STOCKS.

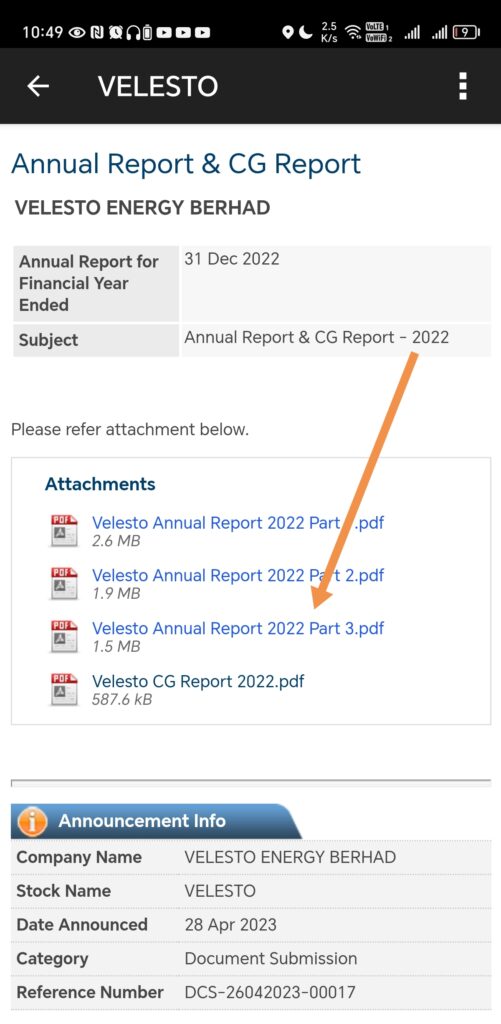

Then, click on Reports tab and click on Annual button and then choose the latest available annual report.

From there, you should be able to see a list of PDF Attachment and the annual report usually named with “Annual Report”. If the annual report is divided into parts, you should examine the final parts. You shouldn’t look for CG Report as CG is referring to “Corporate Governance”. This is not something we want to discuss in this article.

In this case, we should look for Velesto Annual Report 2022 Part 3.pdf.

Scroll to the bottom of the document and look for “Shareholding” section. Every public listed company should have Shareholding information in their annual report. Here, you should find 10 names and if the name exists, you can proceed to buy the fund:

- Permodalan Nasional Berhad (There is no fund by PNB. But usually PNB will give bonus to ASB unitholders).

- Amanah Saham Bumiputera

- Amanah Saham Bumiputera 2

- Amanah Saham Bumiputera 3

- Amanah Saham Malaysia

- Amanah Saham Malaysia 2

- Amanah Saham Malaysia 3

- Lembaga Tabung Haji

- Employees Provident Fund Board

3. Buy the fund and forget it

Provided the company you interested to own did have owned by either of the fund, you can proceed to buy the fund. When you buy the fund, you can assume that you are actually owning the company through the fund.

Since the listed fund above do have fixed price unit (where provided if you deposit RM 10 today, you should get RM 10 if you withdraw tomorrow), your capital presumably not at risk.

When that company distribute a dividend to its shareholders, you will get the juice since the fund that you are subscribed to will distribute profit to you via yearly dividend.

Chances, we are not too rich to take risk. Don’t be greedy and let’s have better sleep at night. Life too short to be scared about the next stock market crash.

Sweet dreamer

Disclaimer: This is neither financial nor investment advice. Please do your own research.